Normally, I stay away from blogging about politics and economics, mainly because most people get completely bent out of shape one way or the other, and anytime you post something about politics or economics everyone thinks they know far more about the state of the country than you.

Yes, the people who barely graduated from your high school and skipped class to go hunting or smoke weed behind the gas station by school suddenly believe that they have degrees from the Kennedy School of Government and the Wharton School of Business because they glanced over an article on Fox News/MSNBC.

That having been said, in 2008 our country experienced the greatest economic correction/collapse in the last 70 years. It occurred based on a number of reasons, but if you look at the history of the United States politics and the United States economy over the last few decades, you'll see it was entirely predictable and why in 2016 we're going to experience another correction/collapse.

Courtesy of jpupdates.com

Firstly, if you look at the history of the United States economy and the political landscape of our country in the last 50 years, you'll see they are inexplicably linked. Here's how.

Over the last 50 years, whenever our country has had a President that has been elected to two consecutive terms, the economy has undergone a serious correction at the end of that president's 2nd term. Below is a breakdown of those administrations and the economic collapse that occurred at the end of their presidencies.

Courtesy of theguardian.com

John F. Kennedy / Lyndon Johnson (1961-1969) - The first case in our scenario is a little different based on the Kennedy assassination though LBJ carried out Kennedy's term and was part of an administration that governed for 8 years, but I would argue it was inevitable as Kennedy would likely have been overwhelmingly re-elected based on poll numbers in 1963 vs. Barry Goldwater. Even with the hesitation shown towards Vietnam, it appears the Vietnam War or at least some troop placement in Vietnam was likely inevitable. Furthermore, Kennedy's ambition and policies likely would have resulted in a domestic policy similar to Johnson's Great Society Plan; perhaps not on the same scale, but likely with the same goals outlined to expand on President Eisenhower's Infrastructure begun in the 1950's.

1968 however was a year of complete turmoil. The economy had been growing at a substantial rate since 1961. However, the issue of the gold standard loomed largely over the heads of the economic policy experts. In 1961 the United States along with several other western European nations (Germany, UK, France, Switzerland, Italy, Belgium, The Netherlands) made contributions to a gold pool based on the Bretton Woods System of a fixed-rate currency to keep the price of gold a level and manageable rate for all democratically governed Western post war nations. The United States contributed 50% of the reserves to the gold pool.

By the mid 1960's inflation had skyrocketed and American gold reserves were being used largely to fund the conflict in Southeast Asia. While the British pound and other monetary reserves devalued, the world economy suffered with a fear that the standard that had been relevant for measuring wealth for a millennium, gold, would be so devalued as to destroy the foundation of Western Economics. This along with the Tet Offensive, anti-war protests, and riots, caused the U.S. economy to suffer a dramatic downturn.

Courtesy of ABCnews.com

Richard Nixon / Gerald Ford (1969-1977) - To say the Nixon/Ford presidencies were one of economic disappointment would be an understatement. In fairness, they inherited a complete disaster in regards to foreign policy from the Johnson administration in Southeast Asia. Furthermore, Nixon also inherited a tax and spend policy that led to The Great Society Plan where budgets and economic spending were seen more as suggestions rather than pillars of economic philosophy. That having been said, Richard Nixon openly admitted he was a Keynesian in 1971 after taking the U.S. off the gold standard.

That statement is a reference to John Maynard Keynes, who is undoubtedly the most influential economist of the 20th century. Keynesian Economics 101 is the thought that the only way to jump start a stagnant economy is massive government spending. While this belief worked in the 1930's, it was too often used in times of economic corrections. A practical Keynesian theorist would argue that the only time a state should employ this logic is when you a have a massive economic collapse, rather than a mere correction. However, politicians eager for high approval ratings and a prosperous economy employed the theory in hopes that by borrowing money against future gains and by increasing the public debt, they would cause the economy to flourish more quickly and thus maintain their power.

After President Nixon took the U.S. off the Gold Standard in 1971, the U.S. economy predictably took a substantial hit. Nixon tried to counter the massive hit the U.S. dollar took in foreign markets by claiming that while the dollar might not be worth nearly as much to Americans traveling overseas, the value would remain the same inside the United States. The dollar ended up plunging in the 1970's to being worth 1/3 of what it was on the gold standard based on this policy.

To make matters even worse during this time OPEC began their oil embargo in 1973 based on the U.S. backing of Israel during the Yom Kippur War, which caused fuel prices to inflate to $5.00 a barrel (I can't even believe I am writing this now, based on current oil prices). This price gouge was completely directed at the U.S. and other Western power in a selective manner based on their support for Israel. It caused U.S. gas stations to ration gas based on license plate numbers and basically crippled the American auto industry.

The Bretton Woods Agreement was basically scrapped and with inflation rising, President Ford, who took over after Nixon resigned, began a campaign to...and I kid you not "WIN" an acronym for Whip Inflation Now. President Ford literally asked the American people to send him ideas on what to do to end inflation. I don't want to go off on a rant here, but if you are the President of the United States and you ask average citizens for ideas on what to do to end an economic crisis, you are not qualified to be the President of the United States. Please step down.

Courtesy of History.com

Ronald Reagan (1981-1989) - To start off things, Reagan inherited a terrible economy from the Carter Administration, but Carter wasn't exactly handed the keys to a Rolls from Gerald Ford either. The early 1980's saw immense, and I mean immense interest rates. Don't believe me? The interest rate in 1981 was 20%. 20 PERCENT! If you're trying to get a loan with a 20% interest rate, you're likely getting a Capital One Credit Card. It was absolutely terrible.

There's a popular myth that Ronald Reagan drastically cut the government based on his famous quote, "Government is not the solution to our problem, government is the problem." Many believed Reagan would drastically cut government programs in favor of a more capitalistic economic theory, and to an extent he did. Reagan's economic theory, known more aptly as "Trickle Down Economics" was based on the belief that if you supply the wealthiest individuals and companies with more incentives (i.e. tax breaks) it would eventually filter down to everyone.

In actuality though, Reagan increased government spending. He cut spending from government welfare programs and re-allocated resources in favor of defense spending. While we could debate all day as to whether or not it was a justified re-allocation, the facts are that the Cold War basically ended because we outspent the Russians. It might as well have been the New York Yankees spending against the Houston Astros in a league with no salary cap.

Cutting taxes and allowing more Americans to keep their own revenue is fantastic and obviously highly popular, but if you do that, you have to make some tough choices and decide what programs are not worth funding.

On October 19, 1987, Black Monday, as it was known, struck Wall Street, but it wasn't just markets in the United States. Markets worldwide drastically decreased, and while economists tried to figure out why the economy tanked, the vast majority blamed the decrease on inflated prices based on computer outputs that were in no way keeping with the actual value of goods. Sound familiar?

Courtesy of JeffJacoby.com

Bill Clinton (1993-2001) - Oh the 1990's. Clinton, like the last 4 presidents before him, inherited a terrible economy, so much so that he literally made it his campaign slogan. During his presidency we saw a complete government shutdown, which the vast majority of the country blamed on Republican leadership in Congress, when in actuality it was a mix of both Presidential and Congressional inability to coexist.

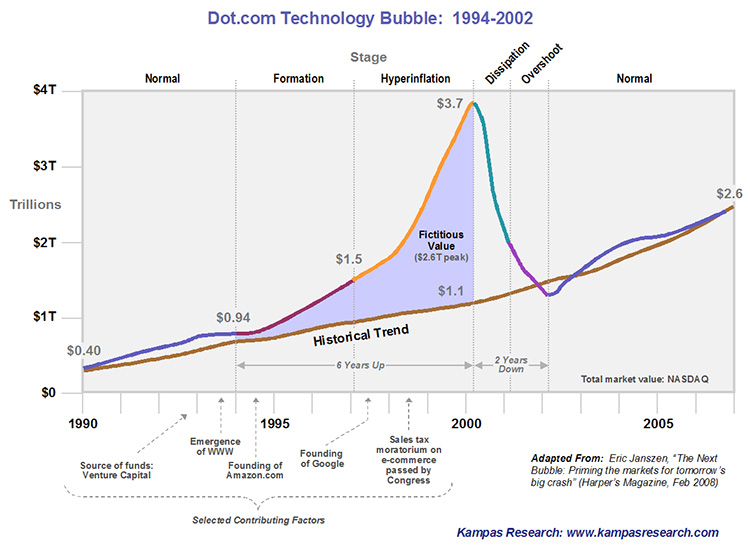

However, the boom and bust of the 1990's all comes down to the "Dot-Com Bubble." To clarify, the invention of the Internet and the widespread development and use in the 1990's caused an inflated concept of value, at a rate never seen before. Companies, that were started in basements were overnight valued at millions of dollars, with little to no justification. This caused the fastest number of overnight millionaires since the 1920's.

Courtesy of Flatworldbusiness.com

Americans were dropping out of college by the gross to strike it rich in the Dot-Com world, much in the same way young adults flocked to Wall Street in the 1920's and 1980's. They did so all in the name of capitalism, based on a new economic medium, that they felt government would not be able to regulate. However, the Dot-Com bubble burst in the Spring of 2000, once the world figured out that many of these start up basement companies were worthless. Companies like Amazon, eBay, and Google obviously profited and sustained their growth, but many others faltered and left their investors penniless. While the Internet remained and has become a necessity for economics and social development, it's initial price left many in the early 2000's wondering if the boom was worth the potential risk associated with deviating from traditional standards.

Courtesy of Wikipedia.com

George W. Bush (2001-2009) - This period saw the worst economic collapse in the last 70 years, mainly based on subprime lending by banking industries that received compensation for making ill-advised loans to unqualified borrowers. This stemmed from several issues. First, federal laws were passed in the 1990's by liberals in an attempt to make home ownership more available to citizens trying to qualify individuals, who should never had been allowed to qualify for loans in the first place.

These "No-doc" qualifying loans set the borrowers up for complete failure, while promising parties they could refinance their loans in 2-3 years when the Adjustable Rate Mortgages (ARM) corrected and allowed for fixed rate terms. Secondly, the lack of government regulation by conservative leaders who believed in pure capitalistic exploits allowed lenders to pass these loans through with little to no oversight and for mortgage loan originators to collect huge commission fees for approving loans they knew were destined to fail. These loans were then packaged together as securities and sold on a secondary market to investors.

Multiple lending institutions involved parts of their businesses in this process, to the point where homes were being valued at 2-3 times their actual value based on grossly inflated appraisal values and promises by all parties that the value would remain at the current rate or higher and that the parties would be able to collect on their investments.

In 2008 the market substantially corrected, and that's being kind. It flat out plummeted. The stock market was around 13,000 points in April of 2008 and by October of 2008 it was below 9,000 points. Brokers panicked. Housing values dropped tens of thousands of dollars overnight. If you were involved in the real estate or building industry in 2008 and you are reading this, congratulations, you were one of the lucky ones. If you haven't seen the HBO movie "Too Big To Fail," I highly advise you to watch it, because it does an excellent job at explaining just how close our country came to another Great Depression.

The Bush Administration and subsequently the Obama Administration both began to issue government bailouts to selected private business entities. This led to the one time since the 1930's that Keynesian Economics worked. These bailouts which were largely criticized in the media, helped dramatically, because without those, you would have seen millions, not thousands, but millions more people unemployed. Credit scores would have plummeted. The number of individuals without homes would have skyrocketed. Furthermore, you'd have seen enormous numbers of unemployment directed at individuals under 30 similar to Europe, especially Southern Europe, i.e. Spain, Greece, and Italy.

The unemployment in those countries has caused massive riots in the streets and a completely stagnant economy that has yet to recover. Protests abound in those countries, and there are numerous properties that were built during the real estate boom that remain vacant. The stock market has clearly recovered, which the Dow Jones being currently valued at over 18,000 points illustrates. However, history has shown this won't last and here's why.

Courtesy of beforeitsnews.com

Lame Duck Presidencies

In the last 50 years two term presidents have generally seen a significant decline in support at the end of their second term. Part of the reason for that is that almost every president, with the exception of LBJ has had the opposing party control Congress.

Bush's Presidency from 2007-2009 saw the Democrats control both houses of Congress. Clinton's Presidency from 1999-2001 saw the Republicans control both houses of Congress. Meanwhile Reagan's entire Presidency from 1981-1989 saw a Democratically controlled Congress, as did Nixon and Ford for their entire presidencies.

The only two term president who had his own party in power at the end of his presidency was LBJ, and I would strongly argue that the Democratic party was largely split over support for the Vietnam War, The Great Society Plan, and the Civil Rights Movement, all major platforms of the Johnson Administration. Democratic hawks backed the Vietnam War while doves opposed it. Social liberals supported The Great Society Plan, while fiscal conservatives opposed it as a tax and spend waste of government resources. Lastly, Democrats in the Northern States (who weren't as directly effected by the movement) largely supported the Civil Rights Movement, while those in Southern States opposed it. These issues led to riots throughout the country in 1968, which obviously helped to contribute to a downturn in the economy.

So why does having the opposing party in power in the legislature make it difficult for an executive to govern? The fact is the opposing party in the legislature knows all they have to is wait out your term, and support their party's candidate and then they can start to pass legislation most favorable to their ideology and campaign contributors. It's the 4 Corners of Politics. Hold the ball and run out the clock.

This complete unwillingness to address pressing issues by the government causes market investors to sell their stocks and other assets believing that the stagnation will continue and their investments will decline, so they better liquidate their assets and transfer them to investments they believe will increase in the coming years. The President's advisers inform him that he needs to lobby Congress for change and new legislation, but Congress stalls the bills in committee's they control and prevent it from coming to a vote. This causes the President to begin issuing executive orders to implement his own agenda, but those orders are only good for that President's term, and the newly elected President is free to either uphold them or dismiss them. Over the next 2 years, you are going to see President Obama hand out executive orders like cash to a 5 star football recruit. He's going to do everything possible to try and cement his policies on the incoming administration.

Elections Mask Economics

The pure reality of the end of a two term president is that about 2 years before his term is up, the media and political machines start pushing for their new candidates. All the major media outlets run stories constantly about who will and who won't run for president. They show graphs and poll numbers 2 years before the first primary as to who random people in Iowa and New Hampshire favor as their candidate.

Once the primaries are over, the real campaign begins with almost every nightly lead story being something involving the candidates from both parties. While this is clearly to be expected, if you look at the 2008 election where during the Summer to early Fall we experienced a complete economic meltdown, what most people remember during that time are stories from the Obama-McCain Campaigns and the Sarah Palin SNL skit.

McCain to his credit did try and address the economic problem and called for both he and Obama to suspend their campaigns to try and address the issue. Obama already knew he had the election won and that most people would see him as the president who could fix the economic situation, and that by working with McCain it would show weakness and an admission that McCain was correct in his assertions.

In hindsight it was a brilliant political move by both McCain and Obama. McCain was able to keep his seat in the Senate and legitimately claim he had tried to fix the crisis but President Obama would not work across the aisle. Meanwhile, Obama was handed the Presidency and blamed the Bush administration for handing him a terrible economic situation, while simultaneously using that situation to pass more government regulation.

The main reasons elections mask economics is because supporters of their candidate see a brighter future ahead if they can just get their candidate elected. Therefore, they pour time, money, and effort into the campaign process which in 2008 saw over $1 billion raised between the two candidates. $1 Billion was generated from individuals hoping to see their candidate elected, when in actuality it would have made far greater sense to allocate those funds to help the struggling economy.

Why Our Economy Will See A Downturn in 2016

While the housing market has somewhat stabilized you still have a large number of properties that are vacant and owned by lending institutions. This causes the banks to be stuck with a large number of devalued assets. Therefore, those banks are trying to unload their assets to clean up their accounting books. Meanwhile savvy investors, who managed to survive the 2008 crash, are going around buying up properties and either re-selling them at inflated prices for profit or renting them. The ownership rate for the average American hasn't returned to normal numbers, because average Americans aren't buying homes. These homes are being bought by investment companies who are buying them cheaply from large lending institutions trying to clean up their books of bad assets. While this may not initially sound troubling, here's where the problems start to develop.

These larger investment companies who are buying up properties and then renting them to average citizens are pooling their assets and selling them to other investors as securities, the same way mortgage loans were securitized and sold to investors. These rental properties and agreements are being bought and sold on a secondary market, the same way mortgage loans were a decade ago at inflated prices with little to no regulation. Additionally, the investors aren't just selling the securitization of the properties they own, they are also selling the monthly rental payments generated by their status as a landlord as an asset, while using the rental agreements and monthly incomes as collateral.

The Dodd-Frank regulations of 2008 placed significant restrictions on lending institutions and the process by which they make loans, specifically housing loans, to prevent another banking collapse. However, it did little to address future problems from investors hedging bets against the rentals of these properties.

The problem with government regulation of business is that it's reactive rather than pro-active. No one tries to address a potential future problem when the economy is doing well, because when you're making money you often don't ask how or why, you're just glad you're making money.

If you look at the economy in the late 1800's and early 1900's, when there basically were ZERO regulations at all on business, you had high booms and high busts in the market. The late 1800's was basically a roller coaster of economic highs and lows. Teddy Roosevelt's administration then began implementing regulations to combat this problem, namely anti-trust regulations to limit the ability of larger companies to corner whole industries and monopolize, and while that did work to combat trust and monopolies it created the ability for investors to enter new markets.

In the 1920's investors focused on the stock market and post WWI boom to grossly inflate prices of almost every industry in the country from wheat and grain to automobiles and sell those speculative prices to other investors. Once parties started to discover the value of goods wasn't what they thought it was they panicked and begin to sell their assets and the prices and value of stocks plummeted. So, in the 1930's the federal government began to put regulations in place to prevent that from happening again, like making commercial lending institutions and investment banks separate entities to create a buffer between the two.

This trend would continue for the next century. Investors find a way to make money quickly in a legal but questionable business practice. The entire economic system is then put in jeopardy because more and more investors place their interest in the same endeavor with hopes of generating greater profits. The market undergoes a correction, followed by government regulation of those practices. The investors who got out in time then move to another business plan and the cycle repeats itself.

The rental asset securities that came about as a result of 2008 crash, is not in and of itself a problem. The problem is that these assets are being overvalued based on inflated speculation. Inflated speculative prices is the belief that goods are worth more than a logical valuation of it based on empirical evidence, because someone down the street paid that much for something similar so that must be what it is worth. When in actuality, the wise decision would be to step back and say, maybe that person overpaid for their asset.

The likely outcome of this is that investors will eventually begin to see that the overvaluation of these securities are not generating the profits they had hoped for or bet on. So, to cover their losses, they'll likely raise rent on their tenants, which will force many of the tenants to have to either vacate or be evicted. This scenario is similar to the adjustable rate mortgages that provided low interest rates initially, but after 3 years caused mortgage rates to substantially increase leaving homeowners with no choice but to either sell the property at a loss or go into default.

Additionally, many of these leases are month to month leases which is going to make the process go even faster. Rather than having to wait for a year to year lease's agreement terms to expire, the landlord can give a tenant two weeks notice and then evict them from their home, regardless if they have paid their rent on time every month. Furthermore, the eviction process in most states is much quicker than a normal foreclosure process and the regulations and laws governing evictions, are often very pro-landlord, especially with the sunset of the Protecting Tenants at Foreclosure Act which expired at the end of 2014.

By 2016 the country will largely be focused on which party's candidate will secure the White House, while the economy again continues to spiral downward. The belief that the Dow is going to remain around 18,000 points through 2016 is just not realistic. The market is almost certainly going to undergo a correction by then.

The silver lining to the very dark cloud that was the 2008 economic crisis was that former homeowners could usually find a place to rent in or near their area. However, if the current trend continues and the landlords are the ones to be hit by the market correction, you can rest assuredly the first casualty will be their tenants.